Energy Assistance Income Limits 2025. The maryland office of home energy programs will be presenting the state plan for the low income home energy assistance program (liheap) for federal fiscal year 2025. Also, income eligibility returned to 50% of state median income.

Eligibility and assistance amounts are based on the number of people in the home, income, type and cost of heating and location. Hhs releases initial fy 2025 liheap funds.

Maryland Energy Assistance Program (MEAP) Harford Community Action Agency, Eligibility and assistance amounts are based on the number of people in the home, income, type and cost of heating and location. Also, income eligibility returned to 50% of state median income.

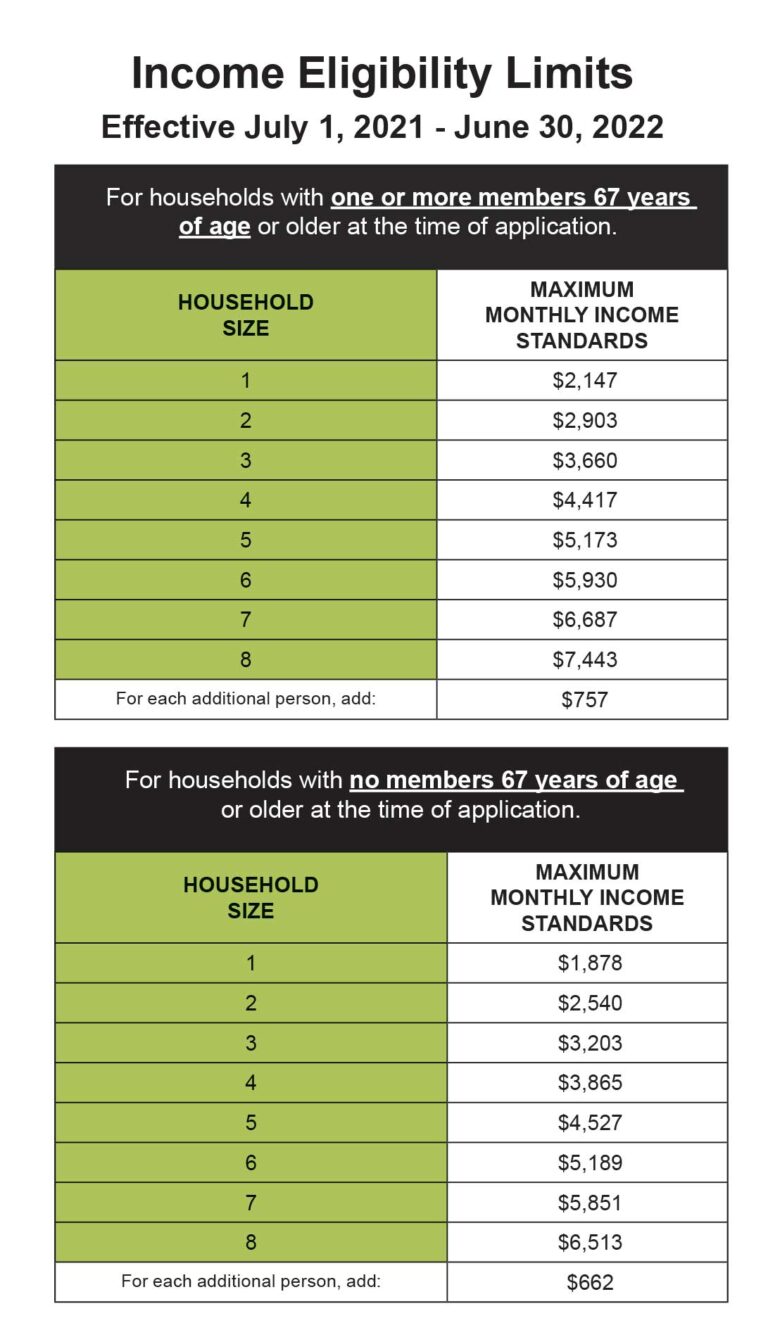

Energy Assistance Program Begins Taking Applications, The energy assistance program application opens oct 2, 2025 and closes may 20, 2025 at 5:00 pm eastern time. Annual household income limits (before taxes) household size* maximum income level (per year) 1:

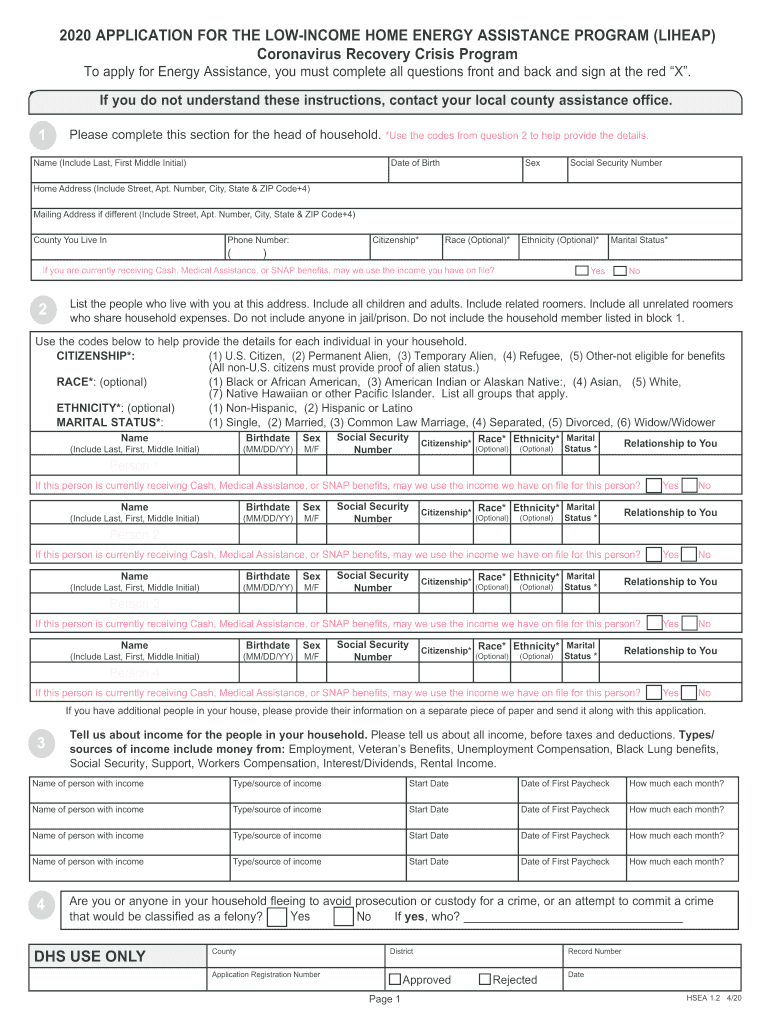

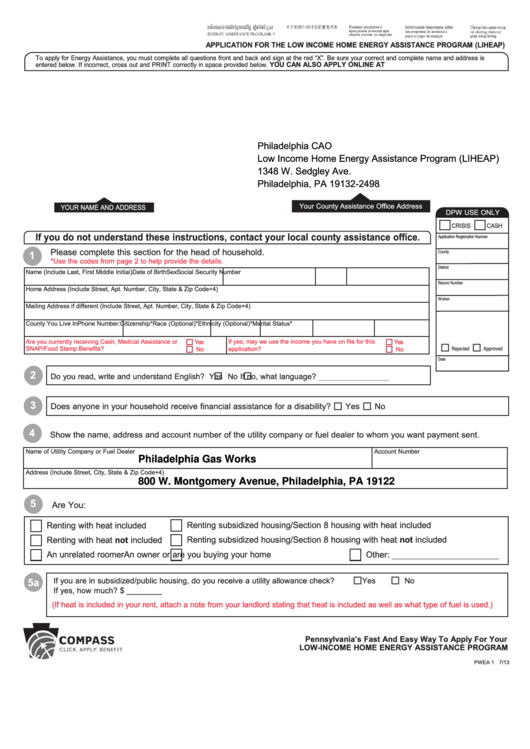

APPLICATION for the LOW HOME ENERGY ASSISTANCE PROGRAM LIHEAP, A household’s income must be at or below 60 percent of north dakota’s median income and within these limits. The department of health and human services (hhs) released $3.7.

Application Period for 20232024 Winter Season of the Connecticut, A household’s income must be at or below 60 percent of north dakota’s median income and within these limits. Annual household income limits (before taxes) household size* maximum income level (per year) 1:

Low Home Energy Assistance Program (LIHEAP) Eligibility, For a list of required documents, view the ceap application (english) , ceap application (spanish). In order to qualify, you must have an annual household income (before taxes) that is below the following amounts:

Benefits of the Home Energy Assistance Program Mortgage, Ceap is accepting applications until may 31, 2025. Annual household income limits (before taxes) household size* maximum income level (per year) 1:

Low Energy Assistance Program (How to Apply) YouTube, Annual household income limits (before taxes) household size* maximum income level (per year) 1: 2025 federal poverty guidelines and definition of income.

Low Home Energy Assistance (LIHEAP) EOA of NWA, Annual household income limits (before taxes) household size* maximum income level (per year) 1: A household’s income must be at or below 60 percent of north dakota’s median income and within these limits.

Liheap Application Form Printable Printable Forms Free Online, What income is included in determining eligibiity for energy assistance? You don't have to be on public assistance;

Energy Assistance Washington County Community Action Council, Beginning october 1, 2025, benefits returned to more typical amounts for most households. View heap monthly income limits.

Concerts In Redding Ca 2025. Find the best concerts in redding 2025. Old city hall arts center; Find the best concerts in redding 2025. Jinx rocks the food truck park in redding:

Evtol Conference 2025. The evtol insights’ montreal conference & awards 2025 is a notable event scheduled to take place from may 1 to may 3, 2025, at le mount stephen, located at 1440 drummond. There's now just over one week to go until evtol insights' montreal conference and we can confirm evtol aircraft developer limosa […]

When Will 2025 W2 Be Available On Adp. Distribute tax statements and earned. The requirement for employers is that w2s must be sent in the mail or make their w2s available online no later than january 31st. In the top right, click the search button and search for w2. 9 by the internal revenue service.