Income Bracket 2025 Philippines. Philippines income tax brackets and other details. How to compute your income.

The compensation income tax system in the philippines is a progressive tax system. This philippines salary after tax example is based on a ₱ 100,000.00 annual salary for the 2025 tax year in philippines using the income tax rates published in the philippines tax tables.

Whether you’re an individual or a freelancer, these updates can make a real difference in how much you pay in taxes.

Tax Bracket Philippines 2025 Desiri Beitris, Certificate of income payments not subjected to withholding tax ( bir form 2304 ), if applicable. The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines.

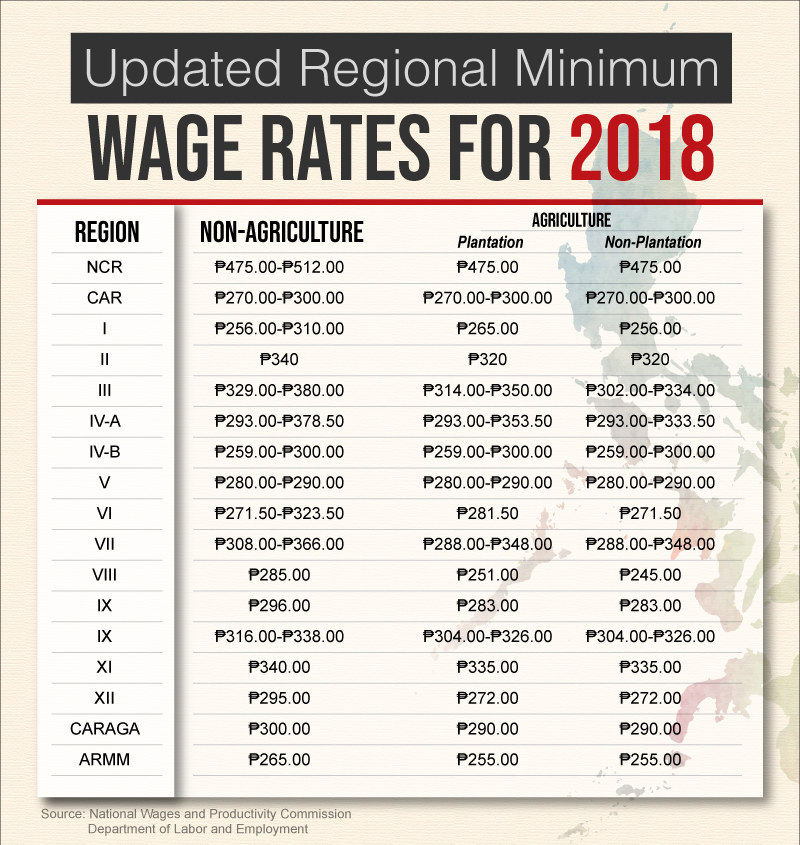

Minimum Wage 2025 Philippines Alta, Based on your remaining income, identify your bracket in the bir income tax table to find the prescribed tax rate. It uses the 2025 bir income tax table for precise results, making sure you follow the latest tax laws.

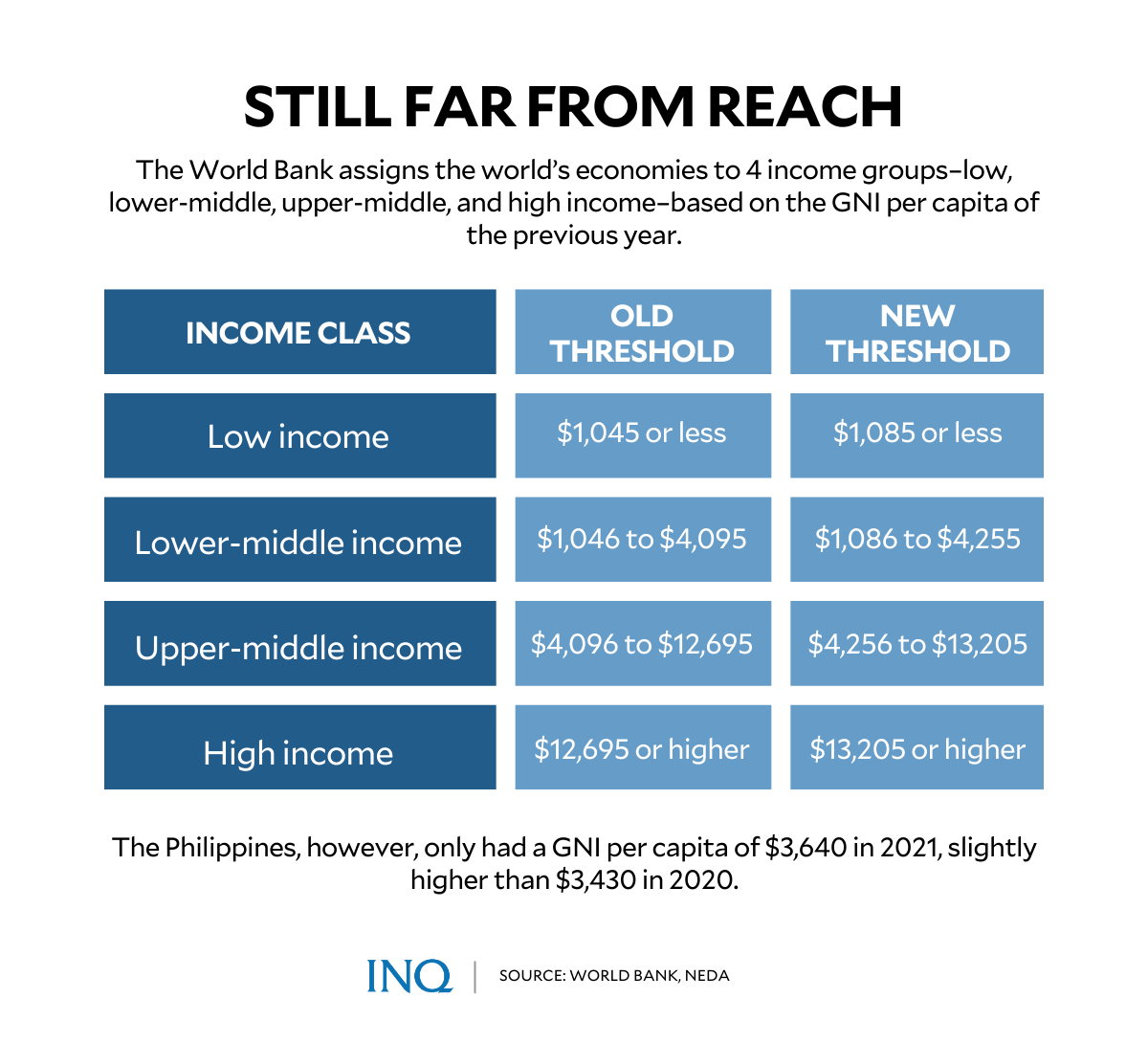

Philippine Classes Where do you belong?, Based on your remaining income, identify your bracket in the bir income tax table to find the prescribed tax rate. This philippines salary after tax example is based on a ₱ 100,000.00 annual salary for the 2025 tax year in philippines using the income tax rates published in the philippines tax tables.

How to compute tax in the Philippines, Citing the philippine statistics authority's family income and expenditure survey (fies) conducted in 2025, the pids said there are seven income groups in the philippines: To calculate income tax for ₱35000 salary in the philippines we need to determine the taxable income, check the compensation range, and then apply the prescribed withholding tax for that range as per the latest bir table:

Delayed or not, will higher PH status mean better Filipino lives, With per capita incomes between the poverty line and twice the poverty line. Also see sample computations of income tax.

Philippine Groups Family Business finance, Class, This includes calculations for employees in philippines to calculate their annual salary after tax. It uses the 2025 bir income tax table for precise results, making sure you follow the latest tax laws.

Tax Brackets 2025 What I Need To Know.Gov Milka Suzanna, Use this income tax in the philippines calculator to help you quickly determine your income tax as a filipino citizen, your benefits contributions, and your net pay after tax and deductions. The average income of filipino families from january to december 2025 was estimated at php 307.19 thousand.

2025 Standard Deductions And Tax Brackets Doro, 35% personal income tax rate for anyone with an annual taxable income of more than p8 million. Welcome to the 2025 income tax calculator for philippines which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your taxable income in philippines in 2025.

Tax Brackets 2025 Calculator Bevvy, Calculate your net taxable income; Philippines residents income tax tables in 2025.

Are you poor, middle class, or rich? Here's how much Filipino, The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines. The average income of filipino families from january to december 2025 was estimated at php 307.19 thousand.

Based on your remaining income, identify your bracket in the bir income tax table to find the prescribed tax rate.